Can an Ignition Interlock Device Impact My Car Insurance Rate?

Getting back on the road after a DUI conviction can be a challenging process. Between fulfilling legal obligations, meeting insurance requirements, and installing an ignition interlock device (IID), there’s a lot to manage. But does having an IID installed affect your car insurance rate? The answer isn’t always straightforward.

What Is an Ignition Interlock Device (IID)?

An ignition interlock device, or car breathalyzer, is a small device installed in your vehicle that measures your blood alcohol concentration (BAC). Before starting your car, you must blow into the device, which prevents the engine from starting if any alcohol is detected. For many, installing an IID is mandatory after a DUI conviction to reinstate driving privileges.

The main purpose of an IID is to ensure that only sober drivers operate their vehicles, significantly reducing the risk of repeat offenses. While the focus is on safety, the cost and presence of an IID can raise additional questions, particularly regarding the impact on your car insurance.

How Do DUI Convictions and IIDs Affect Car Insurance?

The Immediate Impact of a DUI Conviction

A DUI conviction is one of the most severe driving violations in the eyes of insurance providers. Here’s how it typically affects your insurance:

- Higher Premiums: After a DUI, insurers classify you as a high-risk driver, which often results in a significant rate increase. Premiums may rise by 50% to 300%, depending on your state and insurer.

- Policy Termination: Some insurance providers may cancel your coverage altogether after a DUI, forcing you to search for high-risk insurers.

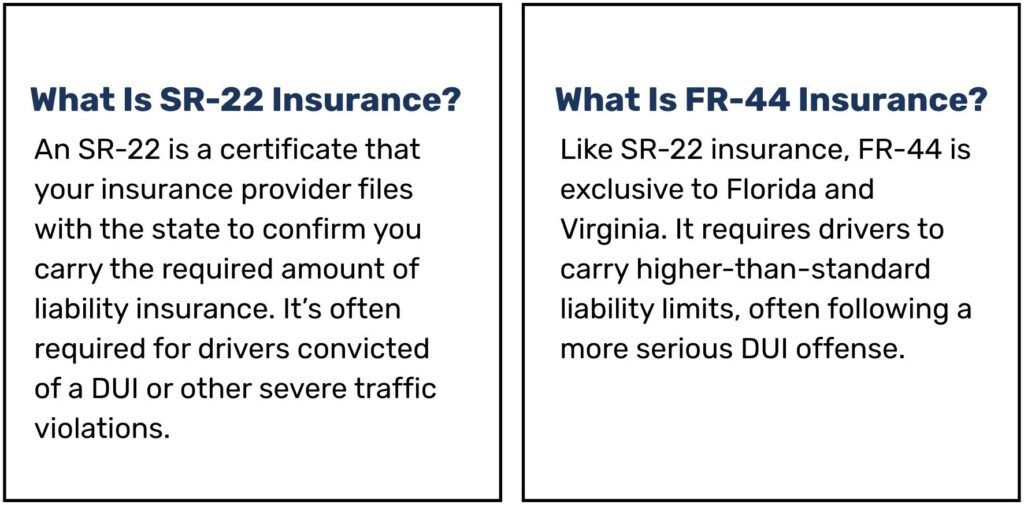

- Limited Options: High-risk drivers must often turn to specialized insurance companies focused on SR-22 or FR-44 filings to meet state requirements.

Can Installing an IID Lower Insurance Rates?

Unfortunately, simply installing an ignition interlock device usually does not lower your current insurance premium. Most insurance companies base their rates on your driving record rather than whether you’ve added safety measures like an IID. However, having an IID may position you as compliant with court requirements, which could prevent additional penalties or complications with your insurer. This perception could benefit you when switching to an insurer that specializes in covering high-risk drivers, as they might recognize your efforts toward becoming a safer driver.

SR-22/FR-44 Requirements and Their Connection to IIDs

Another factor that can impact your car insurance after a DUI is the requirement for an SR-22 or FR-44 certificate. These certificates serve as proof of financial responsibility, ensuring that you meet your state’s minimum liability insurance requirements. Installing an IID does not replace the need for SR-22 or FR-44 insurance. However, failure to maintain compliance with IID usage could affect your SR-22/FR-44 status, potentially resulting in higher premiums or even license suspension.

Tips for Managing Insurance Costs After a DUI

While the financial impact of a DUI can be significant, taking proactive steps can help mitigate costs and get you back on track.

Shop Around for High-Risk Insurance

Not all insurance companies specialize in covering high-risk drivers. Research insurers that focus on SR-22/FR-44 policies or offer specialized coverage for DUI offenders. Comparing quotes from multiple providers can help you find the best rate.

Look for Discounts

You might still qualify for discounts, even as a high-risk driver. Ask your insurer about potential savings for:

- Bundling multiple policies (auto and home insurance, for example)

- Taking defensive driving courses

- Installing additional safety features in your car

- Maintaining a clean driving record moving forward

Consider a Non-Owner Policy

If you don’t own a vehicle but must maintain insurance to meet SR-22/FR-44 requirements, a non-owner policy may be a cheaper alternative. These policies cover liability when driving vehicles you don’t own.

Work on Improving Your Driving Record

Time and better driving habits can help rebuild your insurance profile. Avoid further traffic violations, and pay fines or fees promptly to show insurers you’ve made positive changes.

Prepare for Long-Term Impact

DUIs typically stay on your driving record for 3 to 10 years, depending on your state. During this time, focus on improving your credit score and driving history, as both can influence your rates over time.

Road to Recovery and Responsible Driving

Dealing with the aftermath of a DUI conviction is undoubtedly expensive and stressful, but it’s also an opportunity for growth. Installing an ignition interlock device and meeting all legal requirements shows your commitment to making responsible choices, and LifeSafer® Ignition Interlock is there to help you navigate IID compliance affordably.

LifeSafer understands the financial strain and will work with you to find any available state deals or provide special discounts if you are eligible. While it may not directly lower your car insurance rates, staying compliant with your IID keeps you on track to rebuild a safe driving record.